Ramaphosa Meets Trump: What It Means for South Africa’s Economy, Taxes & Trade

- Bryden Nair

- May 27, 2025

- 3 min read

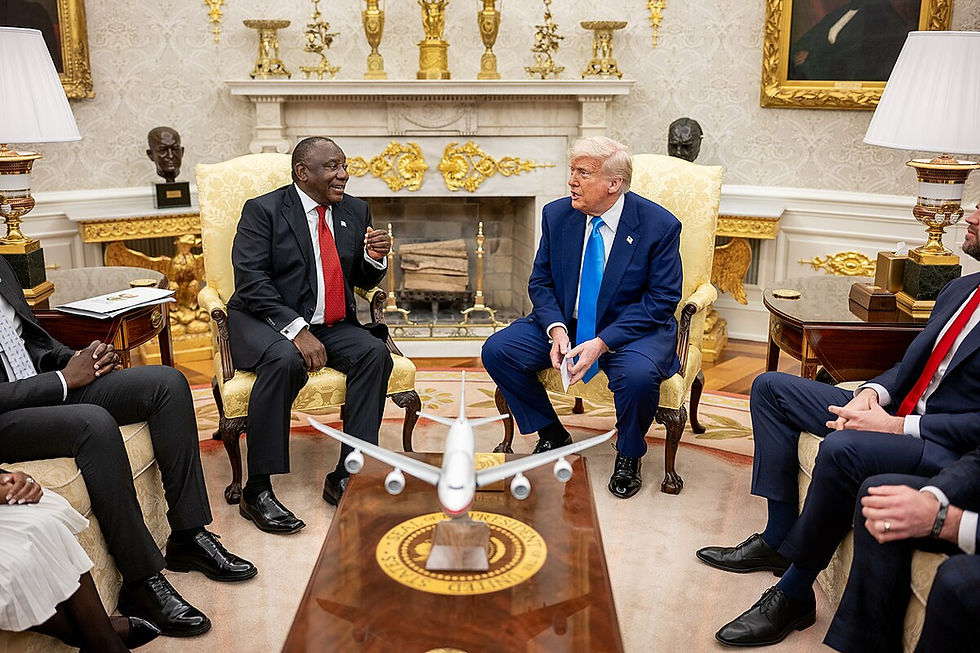

President Cyril Ramaphosa’s recent visit to the United States to meet with President Donald Trump has dominated headlines for all the right — and wrong — reasons. While political tensions surfaced, the trip also opened the door to potentially significant shifts in South Africa’s trade relationships, energy investments, and future tax revenues.

In this post, we break down the key developments from this high-stakes meeting and explore what they mean for South African taxpayers, business owners, and investors.

🔑 Key Highlights from the Trump–Ramaphosa Meeting

1. A Multi-Billion Rand LNG Deal in the Works

One of the most concrete outcomes of the meeting was South Africa’s proposal to purchase between 75–100 million cubic meters of liquefied natural gas (LNG) from the United States annually, over a 10-year period. This deal, estimated at R17 billion to R22 billion per year, aims to transition South Africa away from coal and toward cleaner energy solutions.

✅ What this means: Expect increased investment in gas infrastructure, job creation in the energy sector, and potential tax incentives for businesses investing in renewable and transitional energy.

2. 30% Tariffs on South African Exports

In a less welcome move, President Trump confirmed that South African exports will face a new 30% tariff under his broader “Liberation Day” tariff initiative, set to take effect in July. This could undermine preferential trade access under the African Growth and Opportunity Act (AGOA) and hurt sectors like agriculture, steel, aluminum, and automotive parts.

⚠️ What this means: Businesses relying heavily on U.S. exports may see shrinking margins and need to consider diversifying their export destinations.

3. Diplomatic Tensions Resurface

Despite trade discussions, the meeting also took a sharp political turn. President Trump repeated his controversial claims about land reform and minority rights in South Africa, to which Ramaphosa responded with clarity and composure — affirming that land reform will remain lawful and constitutional.

🤝 What this means: While political rhetoric may strain diplomatic relations, trade pragmatism remains intact — for now.

📊 Financial & Tax Implications for South Africans

• Energy Sector Investment May Unlock Tax Incentives

With LNG now on the table, businesses entering the gas or renewable energy space may benefit from Section 12L energy efficiency deductions or infrastructure-related allowances. This could reduce taxable income and improve long-term cash flows.

• Revenue Collection Pressure for SARS

Finance Minister Enoch Godongwana recently warned that spending cuts may be required if SARS misses its collection targets. Trade instability, like reduced export volumes due to tariffs, could reduce company profits and VAT collections — putting pressure on national revenue.

• Potential Shifts in Tax Policy

To compensate for international uncertainty, Treasury may explore domestic tax reforms. Watch for possible adjustments in corporate tax, carbon levies, or energy-related tax relief.

🧭 What Should SA Businesses and Taxpayers Do Next?

1. Reassess Export Strategy

Companies should consider exploring new markets across Africa, the EU, and BRICS partners to mitigate U.S. tariff exposure.

2. Monitor Legislative Changes

Stay informed on potential tax changes — particularly around energy, trade-related deductions, and customs duties.

3. Leverage Expert Advice

Now more than ever, strategic tax planning is essential. Speak to a qualified tax advisor (like Horizon Trading Solutions) to assess the impact of these developments on your bottom line.

💬 Final Thoughts

While political drama made the headlines, the real impact of President Ramaphosa’s visit to Washington lies in the policy shifts it may catalyze — in trade, taxation, and energy. As we await further developments, one thing is clear: proactive financial planning is the best response to global uncertainty.

📞 Need help navigating these changes? Contact Horizon Trading Solutions today for tailored tax and business advisory services.

Comments